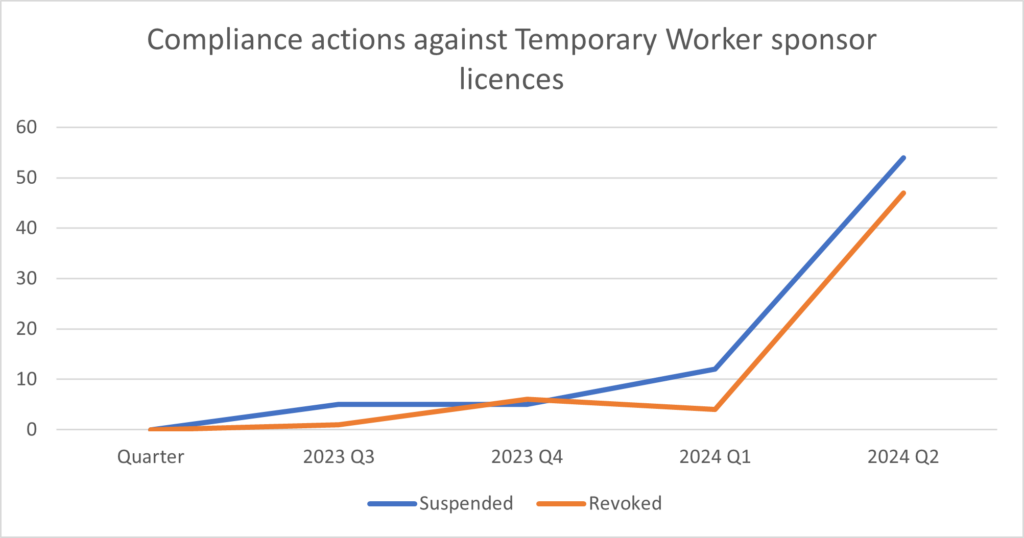

Home Office action against Temporary Worker sponsors, including Creative Worker sponsors, has skyrocketed, as reflected in this chart.

Source: Sponsorship transparency data: Q2 2024 – GOV.UK

Changes Immigration had the pleasure of assisting creative arts agency Frusion in defending its Creative Worker sponsor licence against revocation.

Please enjoy the above recording of Ian Smith of Frusion’s chat with Samar Shams, Managing Partner of Changes Immigration, for insights into compliance visits and tips when challenging Home Office action against a Creative Worker sponsor licence.

Ian and Samar touch on the following topics and much more:

- Many sponsored Creative Workers are self-employed. Ensure that the Home Office does not assess your compliance under employment regulatory frameworks that do not apply to self-employment such as National Minimum Wage requirements and the Working Time Directive.

- When sponsoring Creative Workers such as musical groups as a unit rather than as individuals, the requirement to ensure that the worker will be making a contribution to creative life in the UK may be fulfilled on the basis of the international status of the unit. In these circumstances, the sponsor is not responsible for verifying the international status of each individual making up the group.

If the Home Office notifies your organisation of a visit or other compliance activity, please contact samar.shams@changesimmigration.com asap to avoid adverse effects on sponsored workers and on business operations. We have an excellent track record in defending sponsor licences.